DUE TO SOME TECHNICAL AND NETWORK ISSUES WE WILL NOT BE ABLE TO POST THE CALLS REGULARLY. THEREFORE, WE WILL POST THE CALLS AS AND WHEN IT IS CONVENIENT. WE ARE TRYING HARD TO RESOLVE THE PROBLEM SOON..

FOLLOW US ON EMAIL

JOIN 500+ EMAIL SUBSCRIBERS. ENTER YOU EMAIL ADDRESS IN THE FORM BELOW AND RECIEVE ALL POSTS DIRECTLY IN YOUR INBOX.

Wednesday, 15 April 2015

Intraday and positional call

Buy yesbank at cmp 863 for intraday target of 870-875 stoploss below 850 can hold it as positional call also for targets of around 900 and stoploss to say..

Tuesday, 14 April 2015

BOOK PROFITS IN ATUL............TARGET ACHIEVED!!!

BOOK PROFITS IN ATUL .......INTRADAY CALL GIVEN........TARGET ACHIEVED

BOOK PROFITS IN BS LTD.....TARGET ACHIEVED!!

BOOK PROFITS IN BS LTD ...........DELIVERY CALL GIVEN ...........TARGET ACHIEVED!!!

View on Nifty For 15-4-2015

On Monday (13-4-2015) Nifty witnessed a very strong session. Except

Monday, 13 April 2015

BTST CALL FOR TOMORROW

Continue to hold HDIL as BTST call with a closing basis stop loss below 136.....

Sunday, 12 April 2015

BOOK PROFITS IN BASF..........TARGET ACHIEVED!!

BOOK PROFITS IN BASF TARGET ACHIEVED ............POSITIONAL CALL GIVEN.

Nifty view for 13-4-2015

Nifty had a lack luster trading session on Friday ending at 8780 near to the previous day closing. Action shifted towards the midcaps.

After the IIP and CPI numbers SGX Nifty indicates a positive opening for Indian Markets. Going forward levels of 8740 and 8825 are expected to act as key support and resistance levels.

After the IIP and CPI numbers SGX Nifty indicates a positive opening for Indian Markets. Going forward levels of 8740 and 8825 are expected to act as key support and resistance levels.

Saturday, 11 April 2015

Your Perfect Emotional Setup Explained Part--3

Without wasting

any time lets continue our discussion.

·

Never

trade more than your account size.

Unfortunately

many traders lose money just because

Friday, 10 April 2015

Promise Reminder

Continuing with our promise to earn profits for you even on closed markets days.

Labels: Stocks, free, market, trading, calls

closed market,

free multibagger calls,

promise,

reminder

Your Perfect Emotional Setup Explained Part---2

Hello

readers, I hope you have started incorporating the concepts explained in

previous articles in your trading values. Lets continue further.

Labels: Stocks, free, market, trading, calls

stocks,

trading,

Trading psychology

BOOK PROFITS IN CENTURY TEXTILE.......ALL TARGETS ACHIEVED!!!

BOOK PROFITS IN CENTURY TEXTILE...........CMP 773 ALL TARGETS ACHIEVED!!

BOOK PROFITS IN NETWORK18..........TARGET ACHIEVED!!!!

BOOK PROFITS IN NETWORK18 TARGET ACHIEVED..............CMP 64.40

POSITIONAL CALL

BUY NETWORK 18 FOR TARGETS OF 62 AND STOP LOSS BELOW 58.CMP 60. CAN PERFORM WELL ABOVE 62

INTRADAY CALL

BUY HPCL ABOVE 668.2 FOR TARGETS OF 673-675 AND STOP LOSS BELOW 660. ABOVE 675 CAN PERFORM WELL

Intraday Call

BUY CENTURY TEXTILE ABOVE 756 FOR TARGETS OF 762-765 WITH STOP LOSS BELOW 744. ABOVE 765 CAN HEAD FOR LEVELS OF 775.

Thursday, 9 April 2015

NOTIFICATION!!

AVOID CANFINHOMES DUE TO A GAP UP OPENING............STAY TUNE DFOR MORE CALLS DURING THE MARKET...

Your perfect emotional setup explained-- Part 1

Thank you

for all your mails and feed backs. We indeed have a good lot of dedicated

readers. As promised I will elaborate

Performance Update 9-4-2015

Nucleus software bought at 191 booked profit at 200 +4.71%

Guj Nre Coke bought at 5.55 booked profit at 5.85 +5.55%

Arrow Coated bought at 430 sold at 415 -3.48%

Pi ind bought at 685 booked profit at 725 +5.84%

Kohinoor foods bought at 62.4 sold at 60 -3.8%

LicHsgFin bought at 430 booked profit at 458 +6.51%

Gross profit +15.33%

Asian paints future bought at 854 sold at 844 -5000

TOTAL PROFIT +15.33% - 5000

Guj Nre Coke bought at 5.55 booked profit at 5.85 +5.55%

Arrow Coated bought at 430 sold at 415 -3.48%

Pi ind bought at 685 booked profit at 725 +5.84%

Kohinoor foods bought at 62.4 sold at 60 -3.8%

LicHsgFin bought at 430 booked profit at 458 +6.51%

Gross profit +15.33%

Asian paints future bought at 854 sold at 844 -5000

TOTAL PROFIT +15.33% - 5000

BOOK PROFITS IN PI INDUSTRIES....TARGET ACHIEVED!!

BOOK PROFITS IN PI INDUSTRIES.......TARGET ACHIEVED!!!

Wednesday, 8 April 2015

INTRADAY CALL

BUY PI INDUSTRIES FOR TARGETS OF 705-710 WITH A STOP LOSS BELOW 670 ..CMP IS 685. IF IT BREACHES 712 STOCK CAN AHEAD TO LEVELS OF 720- 725

Book PROFITIS in LICHSGFIN

LIC HSG FIN positional call given (view here) at 430 target achieved 458 book profits..!!!

BOOK PROFITS IN GUJNRECOKE.............TARGET ACHIEVED....

BOOK PROFITS IN GUJNRECOKE.........TARGET ACHIEVED.........CMP:6.35

BOOK PROFITS IN NUCLEUS SOFTWARE......TARGET ACHIEVED!!!!

BOOK PROFITS IN NUCLEUS .....TARGET ACHIEVED .........CMP:214

"YOUR PERFECT EMOTIONAL SETUP"

Trading is an art. It is a blend of technical knowhow and an

emotional set up. While we will be discussing the technical aspects in other

articles, let us discuss how to define a perfect emotional setup.

It is rightly said “Trading is not

Performance update 8-4-2015

Suven Life bought at 319 profit booked at 330 +3.45%

Natco pharma bought at 2650 profit booked at 2698 +1.8%

Hdil bought at 128 profit booked at 136 +6.25%

Gross Profit +11.5%

Voltas future bought at 296 booked profit at 297.5 +1500INR

TOTAL PROFIT +11.5% +1500INR

Natco pharma bought at 2650 profit booked at 2698 +1.8%

Hdil bought at 128 profit booked at 136 +6.25%

Gross Profit +11.5%

Voltas future bought at 296 booked profit at 297.5 +1500INR

TOTAL PROFIT +11.5% +1500INR

Tuesday, 7 April 2015

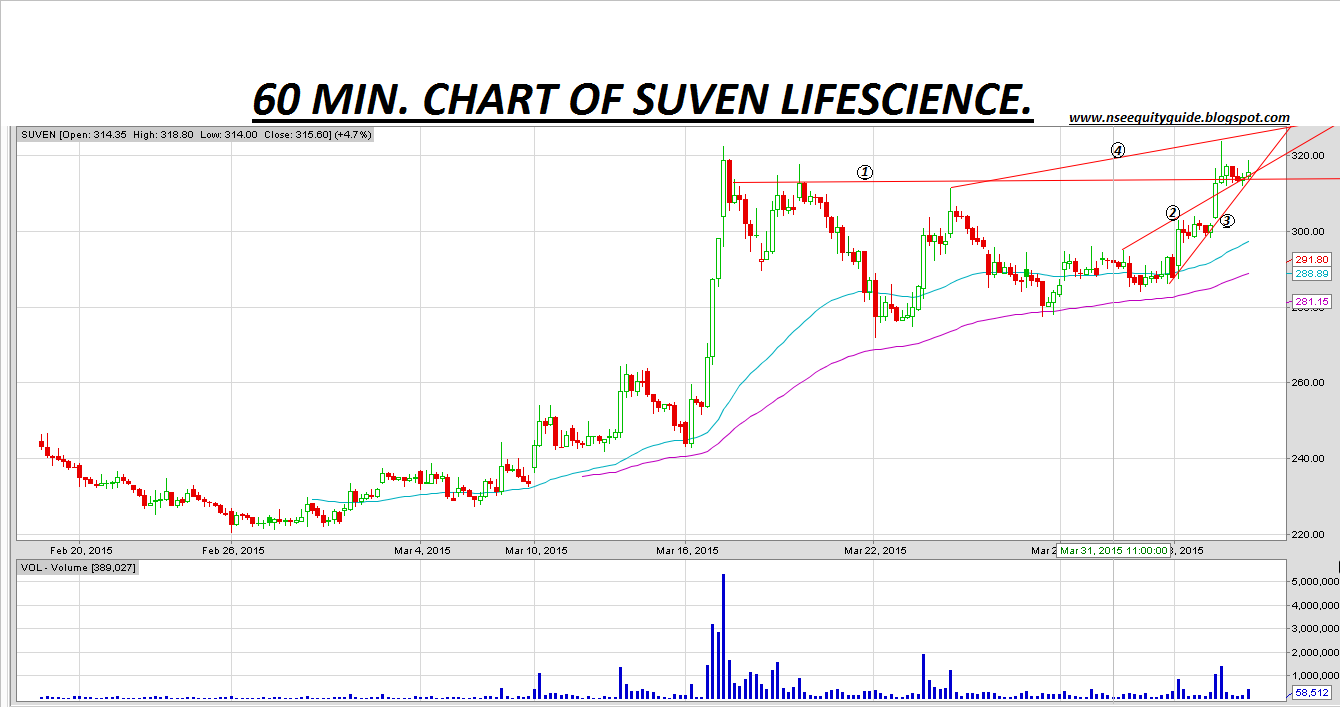

60 MIN. CHART OF SUVEN LIFESCIENCE.

INTRADAY CALL FOR WEDNESDAY(8-04-2015).

Shown above is the 60 minutes chart of Suven Lifesiences. As we can see that the stock has given a breakout in today's trading session. The stock has given a triple top breakout and also a trend line breakout marked as '2'. The moving averages are also supporting the trend. The stock has also given a breakout of a triangle in 5 minutes chart and has rested on the upper band of the triangle. Therefore, I am expecting the stock to gear for levels of 327-330. It would be safer to buy the stock above 319 and maintain a stop loss below 310.

Nifty view for 8-4-2015

On 07-04-2015 Nifty rode a violent roller coaster owing to

RBI’s Credit Policy. RBI’s status quo decision created indecisive trading

sentiments. That is the reason why Nifty oscillated in a 100 points range

today. The extremes marked by Nifty today are very important for making further

trading decisions. Charts suggest that support for Nifty tomorrow lies at 8590

and resistance at 8690.A above beyond either level shall decide the future

course of action.

" THE THREE MARKET IDIOTS"

In the race to trading the markets we come across 3 types of idiots. Read it and try to avoid these laggards.

Idiot 1: The True Believer.

Everyone has come across this category of idiot in the market. For me, I have met several of them. They are the one's who have figured out the only answer to the market. It is in the form of some astrological and mathematical scheme, and of course for them it's a HIDDEN SECRET

PERFORMANCE UPDATE(7-4-2015)

Kitex Garments bought at 653 profits booked at 673 +3.06%

Suzlon bought at 28.7 booked profit at 29.5 +2.79%

Skf India bought at 1515 booked profit at 1520 +0.33%

GROSS PROFIT +6.18%

Apollo tyre bought future one lot at 178 profit booked at 181.4 +6800INR

TOTALPROFIT +6.18% +6800INR

Suzlon bought at 28.7 booked profit at 29.5 +2.79%

Skf India bought at 1515 booked profit at 1520 +0.33%

GROSS PROFIT +6.18%

Apollo tyre bought future one lot at 178 profit booked at 181.4 +6800INR

TOTALPROFIT +6.18% +6800INR

BOOK PROFITS IN SKF INDIA

As the markets seems to be volatile and indecisive, I advice to book profits in SKF India at CMP:1520.

60 MIN. CHART OF SUZLON

BUY SUZLON FOR TARGETS OF 29.70-29.80 AND STOP LOSS BELOW 27.70 .......CMP IS 28.70

Monday, 6 April 2015

BOOK PROFITS IN KITEX GARMENTS..........TARGET ACHIEVED!!!

BOOK PROFITS IN KITEX GARMENTS TARGET ACHIEVED.........HIGH MADE 673...

Daily Chart Of Kitex Garments

Shown above is the daily chart of Kitex Garments. As we can see on the chart that the stock has given breakouts of firm resistances with higher volume. The stock has given a breakout of an upward sloping trend line and a very long consolidation range which was proving to be a good resistance for the stocks. Also the moving averages are lined up for a outburst. Therefore, I suggest to buy the stock for targets of 670-675 maintaining a stop loss below 635.

60 MIN. CHART OF SKF INDIA.

INTRADAY CALL FOR TUESDAY(7-04-2015).

Shown above is the 60 minutes chart of SKF India. As we can see the stock has given multiple breakouts in this trading session. Coming to the breakouts, the stock has given a triangle breakout at 1440 marked by '1' and '3'. The stock has given a breakout of an area of resistance engulfed by the lines marked as '4' and '5'. The stock has given a breakout of a upward and downward sloping triangle marked as '2' and '3' respectively. The stock has also given a breakout of a gap in the chart with high volumes. Therefore, I expect the stock to gear for levels of 1550 but it would be safer to buy the stock above 1514 maintaining a stop loss below 1470.

NOTIFICATION!!

OWING TO REQUEST FROM MANY OF OUR VISITORS, WE WILL START GIVING A CALL ON STOCK FUTURES DAILY FROM TOMORROW.............

Intraday Call For Tomorrow To Be Posted Tonight BY 9 pm

STAY TUNED FOR INTRADAY CALLS FOR TOMORROW BY 9 PM.

PERFOMANCE ON 6-4-2015

PROFIT

Indswftlab bought at 33.25 booked profit at 34.2 +2.92% IFB Ind. bought at 645 booked profit at 655 +1.55%

BF Utilitie bought at 787 booked profit at 800 +1.65%

Jain Irrigation bought at 62.7 booked loss at 61.6 -1.75%

+4.37%

Indswftlab bought at 33.25 booked profit at 34.2 +2.92% IFB Ind. bought at 645 booked profit at 655 +1.55%

BF Utilitie bought at 787 booked profit at 800 +1.65%

Jain Irrigation bought at 62.7 booked loss at 61.6 -1.75%

+4.37%

CORRECTION

A CORRECTION HAS BEEN MADE REGARDING THE CHART UPDATE......IT IS THE CHART OF BFUTILITIE......NOT ABAN OFFSHORE

60 MIN. CHART OF BF UTILTIE

Shown above is the 60 minutes chart of BFUTILITIE. As we can see that the stock has given multiple breakouts.The level of 758 which was acting as a firm resistance has been breached by the stock.Also the stock has given a breakout of a conical triangle with moving moving averages supporting the trend and increasing volume. Therefore, I suggest to buy the stock above 787 for targets of around 798-800 and stop loss below 772.

Sunday, 5 April 2015

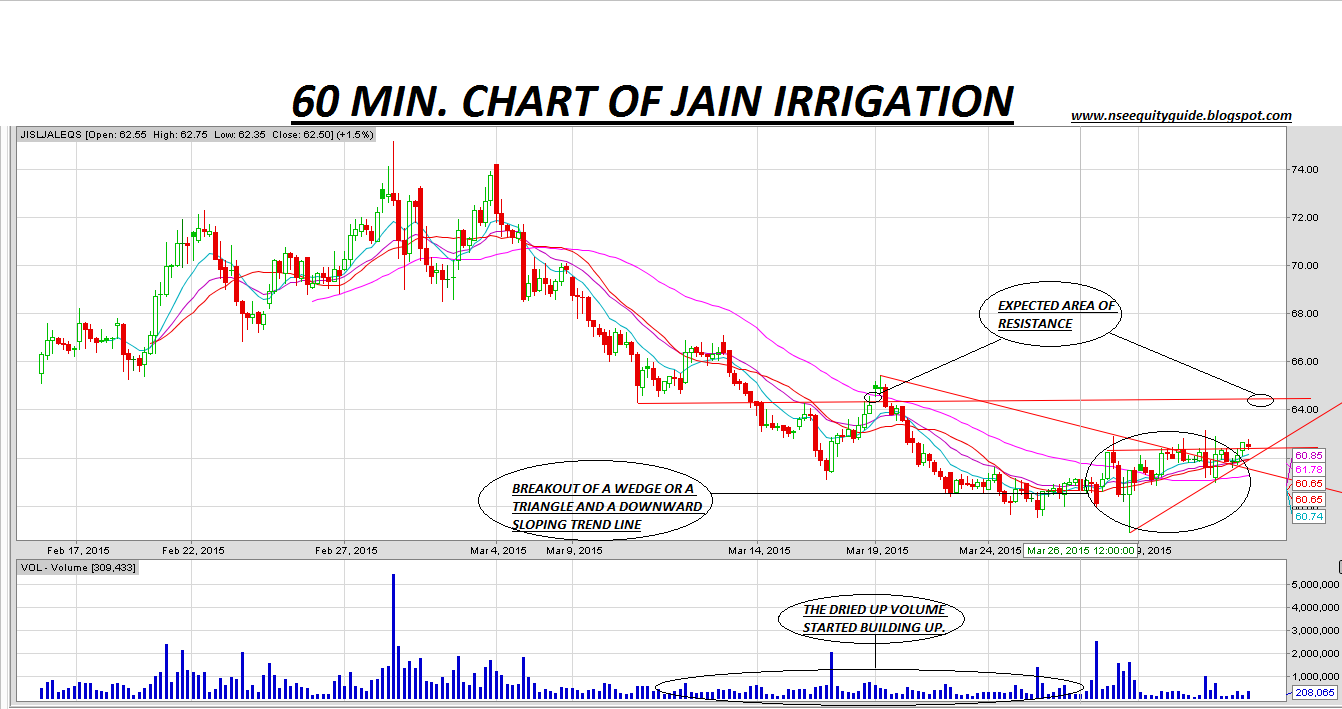

60 MIN. CHART OF JAIN IRRIGATION

Shown above is the 60 minutes chart of Jain Irrigation. As we can see that in the last trading the stock has given multiple breakouts. A triangle or a wedge pattern breakout and also the breakout of a firm downward sloping trend line. The level 62.3 was stopped by the stock a couple of times in recent days making it as a strong resistance, but the stock has breached the level unlocking higher levels. Also we can the moving averages are lined up very nicely in a perfect bullish pattern holding the stock to give an upward thrust. In addition to the breakouts, the dried up volume off the stock has also started building with accumulation at lower levels. Therefore, I suggest to buy the stock for intraday targets of about 64.2 maintaining a stop loss below 61.60.

60 MIN. CHART OF IND-SWIFT LABS.

Shown above is the 60 minutes chart of Indswftlab. As we can see that in the last trading session the stock had given multiple breakout of a trendline and also of many tops which were acting as a good resistance. Also the 20-day moving average has crossed the 50-day moving average on the upside indicating a buy signal for the stock. The trend line joining the lows marked as 'I' and 'J' will act as a good support coupled with the tops. Therefore, I suggest to buy the stock for targets of 34.2 maintaining a strict stop loss below 32.2.

MULTIBAGGER-BEL

Labels: Stocks, free, market, trading, calls

free multibagger calls

BIDS CLOSED!!!

Bids are closed for the Nifty Bonanza Contest......Results will be declared on Friday(10-04-2015) at 6 pm.

"Vices That Are Hindering Your Success As a Trader"

Every successful trader blames his luck for his failure. But have you ever self analyzed your vices?No, for every loss making trade you blame your fortunes, that's it. But today give yourself a chance to know about the vices that have changed your success. As you read, try to question yourself "Do I have any of these vices?" Once you identify your hindrances, you can work upon them to separate them from you.

Saturday, 4 April 2015

NOTIFICATION!!

A new section called POSITIONAL CALLS added in the blog to make it easily navigable................

MULTIBAGGER-DHFL.

DHFL

DHFL is in the Housing Finance Sector with registered office at Mumbai. When "Ab Ki Baar Namo Sarkar" played through the Dalal Street, this was a stock that partied hard. A major run from 220 levels to around 570 was a perfect reward for patient investors.But even after the run we chose DHFL for you. Why?

Layout changed..!

Layout of the blog has been changed to provide more ease to the visitors. Navigate all the columns of YOUR blog. If you have any suggestions regarding making the blog better, feel free to fill the feedback form below.

Elliot Wave Analysis on TRIL.

Shown above is the weekly chart of Transformers And Rectifiers Ltd. As we can see that the stock has given multiple breakouts of a triple top and a head and shoulder pattern in the last week. Also the stock is sustaining above all the moving averages. As we can see, a few weeks ago the 200-day moving average had crossed the 50-day moving average on the downside,giving strength to the stock. The 100-day moving average seems to be forming a perfect rounding bottom formation indicating an up move for the stock. Coming to the Elliot Wave count,

"Reason Why 90% People Fail In Stock Market"

Have you wondered why only a handful say 5 in 100 or 10 in 100 people are able to earn in the stock market? All the others fail. A major reason about this is their perspective about markets. Yes, they treat the markets to be a gambling spot. They trade in stock market like playing in a casino. There is a thin line between investing and gambling. Such traders prefer staying on the other side.

Friday, 3 April 2015

Nifty Bonanza Contest

Hey there? Get ready for a bonanza contest. Predict the closing of Nifty on 10-04-2015 (Friday). Bids open till Sunday 8 p.m.. The closest bidder will receive an exclusive gift hamper. Post your bids in the comments below.

MULTIBAGGER STOCK-GSFC

GSFC

Indian Markets were closed today(03-04-2015) on account of Good Friday. Yes, it's time for a multibagger call at NSE Equity Guide.

Today's multibagger call is GSFC(Gujarat State Fertilizers and Chemicals).

GSFC is a Gujarat based fertilizer company. It is one of the top three companies in the fertilizer business.

Four simple straight reasons:\

CMP:86

Nifty Weekly Outlook

After three red weeks Nifty started its journey on a

positive note with a gap up opening on Monday (30-03-2015) after a deep crack

from 9119 to 8269. It was on Monday that the Indian Markets witnessed a sunny

morning after long dark days of bearishness. Nifty took a breath after the

continuous downfall, on Monday soaring nearly 2% with a gap up opening at 8492.

After a small breather on Tuesday it again rallied 1.15% on Wednesday and ended

the short week at 8586.

Going ahead,

NIfty Bonanza Contest

Hey there? Get ready for a bonanza contest. Predict the closing of Nifty on 10-04-2015 (Friday). Bids open till Sunday 8 p.m.. The closest bidder will receive an exclusive gift hamper. Post your bids in the comments below.

Thursday, 2 April 2015

Trading Psychology

Your trading psychology is a very important factor that

decides and dictates your success and failure. A balance of discipline combined

with the capability of taking risks determines your stay in the market.

Knowledge, experience and skills all turn out to be a fruitless if you do not

have a proper mental and emotional setup.

MULTIBAGGER- Balmer Lawrie.

BALMER LAWRIE

Indian Markets were closed today(02-04-2015) on the occasion of Mahavir Jayanti. Following our promise to make money for you even in a closed market. Here's a multibagger stock that can resize your portfolio into a king size; Balmer Lawrie.

Yes, Balmer Lawrie Compant Ltd. is a multiactivity company. It has a diversified business portfolio from Packaging to Logistics Infrastructure , from Grease and Lubricants to Engineering and Technology. Balmer Lawrie has struck the right note every time. Let us see why Balmer Lawrie can make your portfolio shine.

FOUR simple straight reasons:

Yes, Balmer Lawrie Compant Ltd. is a multiactivity company. It has a diversified business portfolio from Packaging to Logistics Infrastructure , from Grease and Lubricants to Engineering and Technology. Balmer Lawrie has struck the right note every time. Let us see why Balmer Lawrie can make your portfolio shine.

FOUR simple straight reasons:

MULTIBAGGER STOCKS!!!!

Earning Money never ends at www.nseequityguide.blogspot.com, it doesn't matters whether the markets remain open or closed. Whenever the markets remain closed, we will be providing a MULTIBAGGER STOCK with full analysis on its technical and fundamental aspects..............STAY TUNED!!!

Wednesday, 1 April 2015

Nifty Bonanza Contest

Hey there? Get ready for a bonanza contest. Predict the closing of Nifty on 10-04-2015 (Friday). Bids open till Sunday 8 p.m.. The closest bidder will receive an exclusive gift hamper. Post your bids in the comments below.

Perfomance Status 1-04-2015

Petron Engg. bought at 257 profit booked at 265 +3.11%

Ganesh Housing bought at 103 profit booked at 106 +3.00%

GSPL bought at 125.5 profit booked at 126.5 +0.8%

TOTAL+6.99%

Ganesh Housing bought at 103 profit booked at 106 +3.00%

GSPL bought at 125.5 profit booked at 126.5 +0.8%

TOTAL

New To Stock Market? Start Here?

A STOCK MARKET is basically an aggregation of large number of BUYERS and SELLERS. By their activity these BUYERS and SELLERS give rise to multiple transactions. There is no physical transfer of goods. All that is dealt in is, SECURITIES. Now what is SECURITY? Well these consist of shares of both listed and unlisted companies. For a layman stock market is similar to a public market where both BUYERS and SELLERS quote prices for an article. The only difference is that STOCK MARKETS deal in SECURITIES unlike public markets where goods and articles are traded.

60 MIN. OF GSPL

Shown above is the 60 minutes chart of GSPL. As we can see that Gspl has given a breakout of a major trend line in the last hour. Also, it has completed an A-B-C correction in the hourly chart. Therefore, I suggest to buy the stock at cmp 125.45 for targets of around 129-130 and maintain a strict stop loss below 122.5.

Subscribe to:

Comments (Atom)

YOU MAY ALSO LIKE

-

BUT NUCLEUS SOFTWARE FOR TARGETS OF 198-200 AND STOP LOSS BELOW 186

-

Continue to hold HDIL as BTST call. Charts still appear good can do well.

-

In the race to trading the markets we come across 3 types of idiots. Read it and try to avoid these laggards. Idiot 1: The True Be...

-

As the markets seems to be volatile and indecisive, I advice to book profits in SKF India at CMP:1520.

.png)

.png)

.png)

.png)